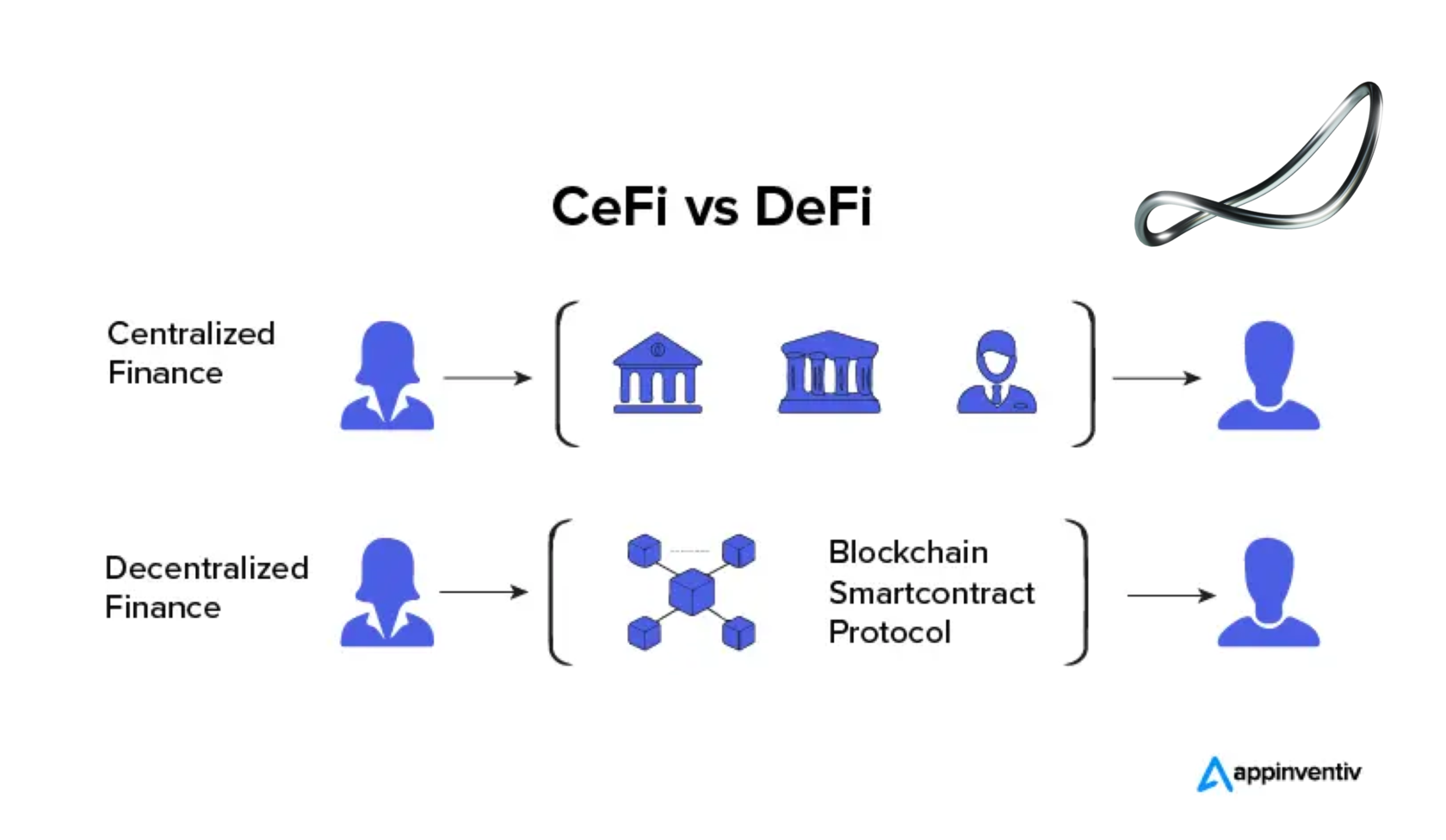

Cryptocurrency has evolved far beyond its initial concept of a decentralized digital currency. Today, it encompasses a vast and dynamic ecosystem that includes various financial services and products. Two prominent terms within this realm are "CeFi" and "DeFi," and understanding the difference between them is essential for anyone venturing into the world of digital finance.

CeFi: Where Centralization Meets Finance

CeFi, or Centralized Finance, is a lot like our regular financial systems. It's where big institutions, like banks and exchanges, handle all your money stuff. Here's what you need to know about CeFi:

1. Central Control: In CeFi, big institutions are in charge of your money. They handle your deposits, trades, and everything in between.

2. Trust in Others: You have to trust these big players to keep your money safe and make sure your transactions happen.

3. Rules and Regulations: CeFi follows the rules set by governments and gets checked by regulators. This keeps things safe but also has some limits.

4. Risk Alert: If the big players mess up, your money is at risk. It depends on how reliable they are.

1. Central Control: In CeFi, big institutions are in charge of your money. They handle your deposits, trades, and everything in between.

2. Trust in Others: You have to trust these big players to keep your money safe and make sure your transactions happen.

3. Rules and Regulations: CeFi follows the rules set by governments and gets checked by regulators. This keeps things safe but also has some limits.

4. Risk Alert: If the big players mess up, your money is at risk. It depends on how reliable they are.

DeFi: Decentralization Takes Center Stage

DeFi, or Decentralized Finance, is a whole new way of doing things. It uses smart contracts and blockchain technology to make finance happen without the big guys. Here's what's special about DeFi:

1. No Middlemen: DeFi doesn't need banks or big institutions. It's direct and trustless, meaning you don't have to rely on others.

2. Everyone's Invited: If you've got internet, you're in. DeFi is for everyone, including people who don't have access to traditional banking.

3. Clear and Open: Everything in DeFi happens on the blockchain, so it's transparent. You can see how things work, making it trustworthy.

4. Free to Innovate: DeFi is open for developers to create new financial stuff without asking for permission. It's a hub for financial creativity.

1. No Middlemen: DeFi doesn't need banks or big institutions. It's direct and trustless, meaning you don't have to rely on others.

2. Everyone's Invited: If you've got internet, you're in. DeFi is for everyone, including people who don't have access to traditional banking.

3. Clear and Open: Everything in DeFi happens on the blockchain, so it's transparent. You can see how things work, making it trustworthy.

4. Free to Innovate: DeFi is open for developers to create new financial stuff without asking for permission. It's a hub for financial creativity.

The Future of Finance

The coexistence of CeFi and DeFi provides users with options that cater to their specific needs and risk appetites. The future of finance is likely to see an increasing integration of both systems, as CeFi entities recognize the potential of blockchain technology and DeFi continues to evolve and mature.

Understanding the differences between CeFi and DeFi is vital for anyone looking to participate in the rapidly evolving world of cryptocurrency and digital finance. It's not a question of one being better than the other, but rather how they can complement each other to provide a diverse range of financial services in the digital age.

For more insights into the world of cryptocurrency and finance, visit Coinbild.club.

Understanding the differences between CeFi and DeFi is vital for anyone looking to participate in the rapidly evolving world of cryptocurrency and digital finance. It's not a question of one being better than the other, but rather how they can complement each other to provide a diverse range of financial services in the digital age.

For more insights into the world of cryptocurrency and finance, visit Coinbild.club.

Disclaimer: The information provided in this article is for educational and informational purposes. It should not be considered financial or investment advice. Cryptocurrency investments involve risks, so thorough research and professional guidance are crucial when making financial decisions.